- June 15, 2024

- admin

- 2 Comments

- Animal Husbandry Infrastructure Development Fund

AHIDF For Dairy Processing Units

Infrastructure is vital for a country’s development. In India, where the economy is largely based on agriculture, improving infrastructure in this sector is especially important. To help farmers increase their income and to support animal husbandry and dairy projects, the need for better infrastructure is growing.

To address this, the Government of India has announced the Animal Husbandry Infrastructure Development Fund (AHIDF) with a budget of ₹29,110.25 crores. This fund will be available until March 31, 2026, under the Atma Nirbhar Bharat Abhiyan initiative.

The AHIDF aims to encourage investments from individual entrepreneurs, private companies, MSMEs, Farmers Producers Organizations (FPOs), Dairy Cooperatives, and Section 8 companies. The investments will focus on:

- Dairy processing and value addition infrastructure

- Meat processing and value addition infrastructure

- Animal feed plants

The Department of Animal Husbandry & Dairying has created this Central Sector Scheme to provide medium- to long-term loans for viable animal husbandry and dairy processing projects. These loans will come with an interest subsidy of 3% per year, available for up to 8 years. Additionally, loans up to ₹2 crores will have credit guarantee coverage under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme.

The scheme will run from 2020 to 2026 and might be extended in the future with a Government notification.

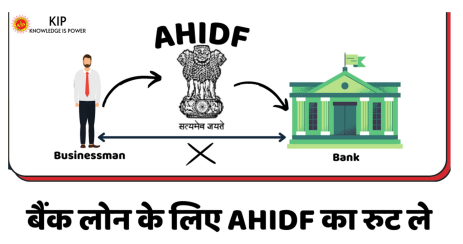

Why opt the AHIDF Route for Bank Loan?

Now question has come in our mind that Why we opt the route of AHIDF for taking Bank Finance. For meet out the fund requirement we need to take bank loan. Further almost Govt. incentives and subsidy benefits are credit linked. That’s why we have to choose the bank very carefully.

But being a loan applicant, you have to face lot of problem such as:

(i) What will be the interest rate?

(ii) How much amount bank will fund?

(iii) How much time bank will take?

(iv) How much security bank will keep?

AHIDF will solve all these problems.

1. AHIDF will share the Interest rate of Bank. Further Interest subvention @ 3% up to 8 years will reduce Interest cost as on regular basis. It will increase the cash flow in business.

2. After selection of Bank and submit project details, PMU will approved the project. After approval of Project, Bank need to take finance decision within prescribed timelines. It will save the time and Businessman can initiate the project timely.

3. Credit Guarantee Cover on Term Loan amount up to Rs. 2.00 Cr make the project more viable. It will create low risk of bank financing and Applicant can start their business with primary security.

4. When you take the route of AHIDF then you can sync your project with other Capital subsidy scheme of Center and State Govt.

5. AHIDF has provided the online working base. It will create fast process of application and boost the quick processing of loan application.

6. Once we take the AHIDF route for Loan then we can get regular interest subsidy up to 8 Years. You need not to submit application again and again on yearly basis.

7. Apart from any New Units, An Existing unit can also take the benefits of AHIDF for creating value addition infrastructure.

8. If you have availed Bank Term on or after 24.06.2020 then you can also take the benefits of said scheme of for interest Subvention.

Benefits:

Now we are going to share the core fiscal benefits available under AHIDF scheme.

1. Interest Subvention: All loans under this financing facility will have interest subvention of 3% per annum. This subvention will be available for a maximum period of 8 years. Further there is no any cap on Bank Term Loan Amount. Whatever the Term Loan Amount, you can take the interest subvention on Entire Term Loan Amount.

2. Interest Subvention on Already Availed Bank Term Loan: Eligible beneficiaries who have already availed bank term loan but not submitted the proposal on AHIDF can also take the benefits of Interest Subvention under this Fund. However, the calculation of interest subvention shall be on interest amount accrued post the date of notification of scheme i.e. 24.06.2020 or loan sanction date whichever is later.

3. Bank Finance up to 90%: The Project under AHIDF shall be eligible for loan up to 90% of Project Cost. The Beneficiaries contribution for Micro and Small Units shall be 10% and in Other Cases it may be 15% to 25%.

4. Credit Guarantee: Credit guarantee coverage will be available for eligible borrowers. From this financing facility under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme for a loan amount up to Rs. 2 Cr.

5. Capital Subsidy: Apart from the benefits of Interest Subvention as provided in AHIDF, Eligible beneficiaries can avail the benefit of any grant or subsidy available under any present or future scheme of Central/State government.

Know More Click Here

For, more information on this you are requested to contact our KIP subsidy helpline on Mail – sales@kipfinancial.com and contact Number– +918683898080

KIP Financial Consultancy Pvt. Ltd.

DSB – 38, Red Square Market, Hisar – 125001 (HR)

can i get full details and get bloan from aihdf scheme

Welcome in KIP

Great thanks for showing interest.

Further, you’re requested to kindly share your contact number so that we can contact to you for your requirements.

You may also connect with us on 8683898080.

Or you can Download AHIDF Specific Business & Subsidy Book : https://rzp.io/l/AHIDF-e-book

Thanks & Regards