- August 19, 2022

- admin

- 0 Comments

- Agro- Based Business

Subsidies on Oil Mill Business

Subsidies on Oil Mill

Hello businessman

Are you dealing in Agro Based Business?

Or you want to start new business?

If yes, then you can think upon this also.

An oil mill is a grinding mill designed to crush or bruise oil-bearing seeds, such as linseed or peanuts, or other oil-rich vegetable material, such as olives or the fruit of the oil palm, which can then be pressed to extract vegetable oils, which may use as foods or for cooking, as oleo chemical feedstock’s, as lubricants, or as biofuels. To know more about it Book your Free Consultancy- https://forms.gle/xye2nyGYMSumfpUB9

The press cake – the remaining solid material from which the oil has been extracted – may also be used as a food or fertilizer.

So, if you want to set up Oil Mill you will get a lot of subsidy benefits from different Government agencies.

Subsidy applicable on Oil Mill:-

Suitable for investment 50 Lakh of Business

PMEGP Scheme-

The scheme is launched by Central Government to generate employment opportunities in rural as well as semi-urban areas by setting up self-employment ventures and projects. The scheme helps small businessman in setting up their new units and upgrade the existing ones.

In this scheme you can start business with investment amount of 50 lakhs and can avail maximum subsidy of Rs. 17,50,000 (35%)

Suitable for investment more than 50 Lakh of Business

Haryana Gramin Udyogik Vikas Yojna-

1) For Capital subsidy:

- 15% subsidy on investment in plant and machinery and Building up to maximum of Rs 20 Lakh for general category.

- 15% subsidy on investment in plant and machinery and Building up to maximum of Rs 25 Lakh for Women and SC entrepreneurs.

2) Interest Subsidy: 7% interest subsidy on term loan up to maximum Rs 8 Lakh per year for 7years.

Suitable for investment more than 1 Crore of Business

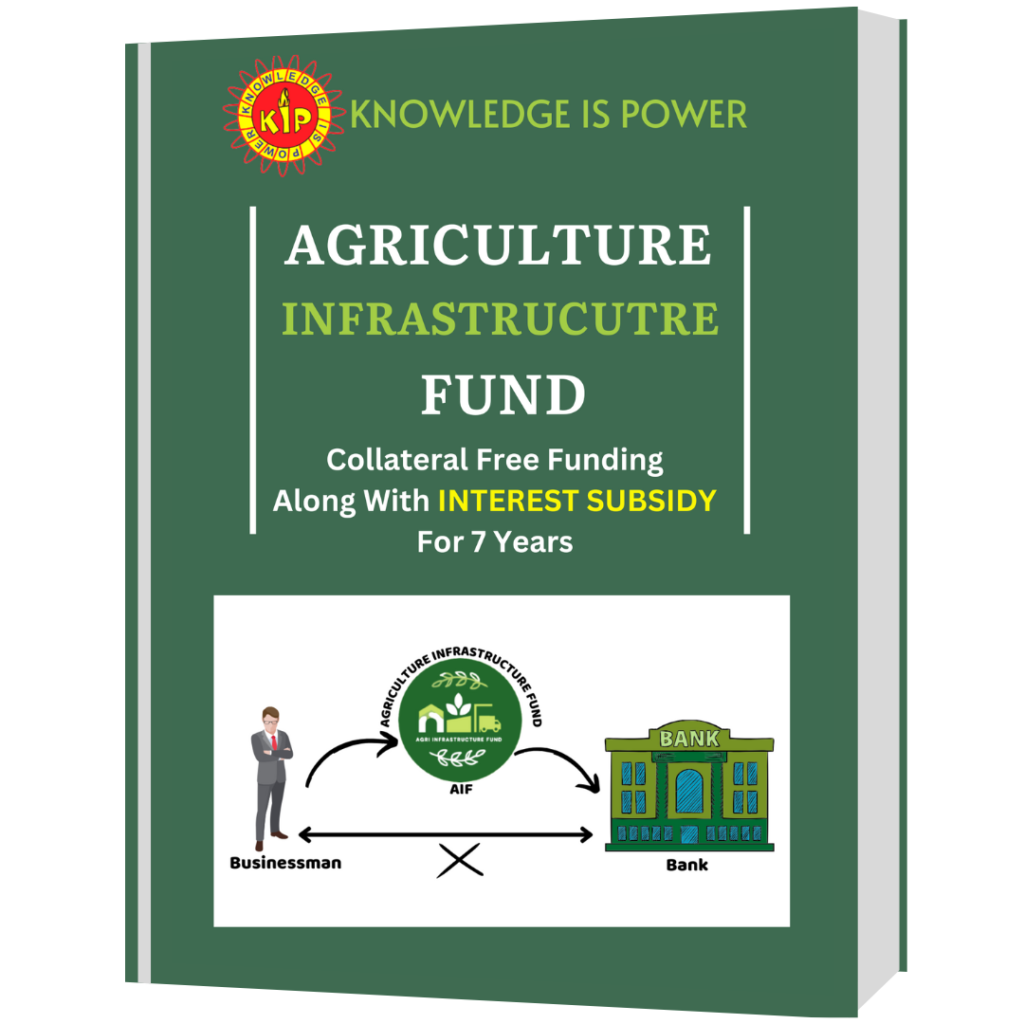

Agriculture Infrastructure Fund-

Interest Subvention Cost-

Interest money will be given by a government for a special use to help an institution, organization @ 3% per annum subject to maximum up to loan of INR 2 crore for a maximum period of 7 years.

Condition: A minimum of 10% of the project cost shall be mandatory as the promoter’s contribution. However, in cases of capital subsidy received, the same amount shall be considered as the promoter’s contribution.

Credit Guarantee Coverage-

The eligible borrower does not have to provide collateral security up to the loan amount of Rs 2 CRORES under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme.

If you want to start this business, KIP will help you in Detailed Project Report. In this report we will help our client in Bank Financing and help them to avail maximum subsidy benefit.

Not only on this business, KIP will help you in different businesses for DETAILED PROJECT REPORT, Consult at 8683898080.

We will also prepare SUBSIDY VIABILITY REPORT, in this report we will tell number of subsidies applicable on single business. If you want to start new business you must know applicable subsidies on particular business.

Fill this form for SVR- https://forms.gle/rwGVoW2ESFU3vWw28

At last, if you want to know more about New Businesses and Subsidies, Join our plan.

KIP: BUSINESS & SUBSIDY UPDATE PLAN– https://rzp.io/l/subsidyupdates

Subsidy Maximization eBooks

Reach Us

Call Us : 8683898080

E-mail Us : sales@kipfinancial.com

KIP Financial Consultancy Pvt. Ltd.

DSB – 38, Red Square Market, Hisar – 125001 (HR)