Financial Health Checkup – CIBIL Report

Have you Check up your Financial Health ?

Till now, Not then You should get it.

I hope, you have listen about physical health check up but not for check up of Financial Health.

In our life there are so many occasion are coming on which we have to take some financial decision such as Buying a Home, A Car, Property or any business startup etc.

Since most of our financial transaction are routed through Banking Channel and generally we approached the Bank for loan to meet out our financial need.

At this time, you need to take care about your financial health.

What is Credit Score Report:

Most of loan application has been rejected by bank due to lower Credit Score. So here we need to understand the meaning of Credit Score. Actually, there are some agencies which are approved by Govt for maintaining the record of credit transactions that you have executed through banking.

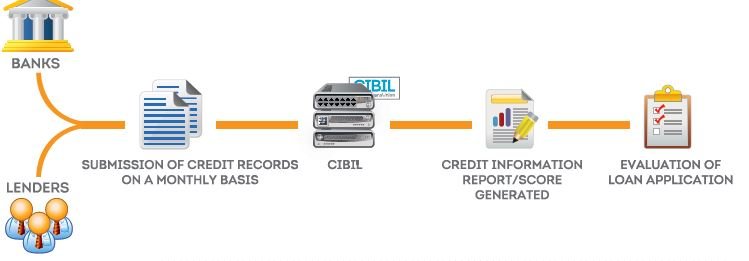

CIBIL Limited is India’s First Credit Information Company that collect and maintain monthly report of Credit Information from Banks and Financial Institutions.

This Credit score report has been used by bank at the time of evaluation of your loan application.

What is Credit Score:

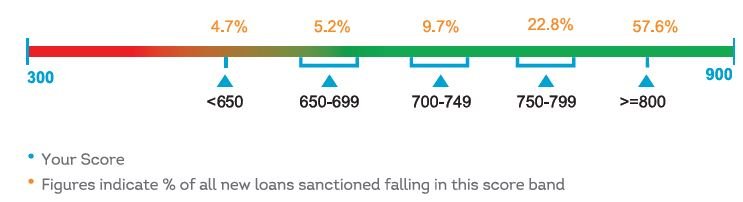

Credit score is a three digit numeric summery of your credit history. The Value ranges between 300 to 900. This reflect the “Probability of Default” of a borrower based on their credit history.

In other word if more score then better financial health and low score then weak financial health.

*Sourced from CIBIL

If your score card is below 700 then it means you are in red zone and there is least chances of approval of your loan. In above example you are seeing that bank will give more preferences to those who have score card more than 750.

The higher your Credit Score, the higher are the chances of your loan application getting approved.

In nut shell, A Credit Report contain the following information as:

- Credit Score

- Personal Information such as PAN, Aadhar Card, Date of Birth, Address etc.

- Loan Account Information (Bank Name, Loan Type and Amount, Delay in loan repayment, Status of Loan Account etc.)

- Loan Enquiry : Listing of your loan enquiry made by till date of report.

Impact of Lower Score:

- Facing problem in Loan Processing

- High Risk of Default in Loan Repayment

- High rate of interest charged by bank on your loan amount.

Reason of Low Score:

- Default in Loan Repayment

- Delay in loan payment

- Compromise or settlement with Bank.

- Given Guarantee to Other Person that has made delay in repayment.

- It may be possible that some other person data has been merged in your report.

Ensure, Regular Checkup:

Now, you can judge the importance of a Credit Score Report at the time of taking loan. So it should be better that you will monitor it as on regular basis.

We at KIP, will help you maintaining your financial health fit and fine. We will help you in:

- Obtaining your Credit Report

- Raising Dispute for correction in Report if any wrong data has been reflected in your Report.

So maintain your financial health fit and fine with KIP.

For more details contact us at:

KIP Financial Consultancy Pvt. Ltd.

DSB – 38, KIP Complex, Red Square Market, Hisar – 125001.

www. Kipfinancial.com

help desk : 90177-51780, 86838-98080, 90171-51780