- July 28, 2023

- admin

- 0 Comments

- New Businesses Opportunities

Subsidy Planning Phase

Timing of execution of a project and different stages of a project has also had a big impact on Right Subsidy Planning. We cannot line up the subsidy in a single time movement. We have to understand the right timing for maximize the subsidy benefits.

We have observed since last 14 years of experience in the Business Subsidy Segment that most of business unit just dropped the subject of subsidy after commencement of business. They forget it after the receiving of Capital Subsidy.

Here important point is that we need to understand the different time phase for make a better subsidy planning and its timely execution for claiming such planned subsidy and incentives.

So, in this chapter we are going to share with you the major “Subsidy Planning Phase”.

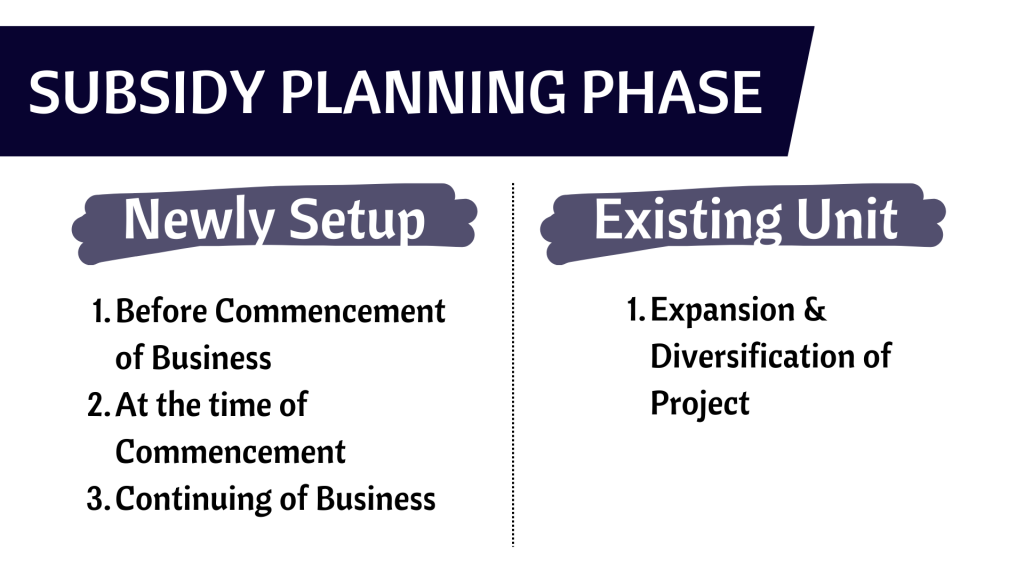

We can understand the Subsidy Planning Phase in Two Ways i.e.

First – Subsidy Planning for Newly Setup Business or New Starter

And second is – Subsidy Planning for Existing Business in case of Expansion or Diversification.

A. For New Project:

As we earlier mentioned that now a business Unit can plan for multiple subsidies and incentives as applicable. So being a businessman you can plan subsidy benefits for your new project as per the following Ph

(i) Before Commencement of Business:

Subsidy Planning has started from the thought of business. If a business unit wants to maximize its subsidy benefit, then it must start subsidy planning before planning of other parameters of business. We can connect subsidy planning in this Phase as:

- Connected with Business Site Selection:

Business site selection is a first decision for a business. So, you should consider the area specific subsidy scheme or policy such as:

- Stamp Duty Refund Scheme on buying of Land for Business Purpose.

- Stamp Duty (Refund) paid on Registered Lease Deed. (Note: Registered Lease Deed Period must be as per the norms of Govt. Policy else your subsidy entitlement or incentives may be rejected.)

- Refund of EDC i.e. External Development Charges that you need to pay on land such as CLU Fees/Development Charges /Labor cess etc. So, you need to ensure proper and timely payment of such EDC Charges for claiming refund thereof.

So, in brief, you can plan above said subsidy at the time of selection of business site.

2. Connected with Banking:

IF you planning to meet out the need of fund from banker for starting the project then at this stage also you can plan for Subsidy and incentives. There are lot of schemes which are credit linked means to say connected with bank finance.

So, before commencement of business, you need to plan for Investment Pattern. How much amount will be self-funded and how much from bank. As per the project nature, you can plan for subsidy under this phase such as:

- Interest Subsidy on Bank Term Loan under various schemes are as:

- AIF- Agriculture Infrastructure Fund for Interest Subvention @ 3% up to 7 Years.

- AHIDF- Animal Husbandry Infrastructure Fund for Interest Subsidy @ 3% on Term Loan.

- MSME- MSME Units will get 5% Interest Subvention up to 5 Years. (May be difference as per state wise)

2. Credit Linked Capital Subsidy such as:

- PMEGP – 25%/35% of Project Cost

- NABARD – 25%/33% of Eligible Cost of Storage and Non-Storage Business

- CLCSS – 15% of Machinery Cost of Max. 1.00 Cr.

- Refund of Collateral Fee Cover i.e paid under CGTMSE Coverage.

- State Specific MSME Capital Subsidy Schemes.

So, when you choose a bank for your project then you must discuss the Credit Linked Based Subsidy and incentives with banker and accordingly plans the Investment pattern in your project.

(ii) Subsidy Planning at the time of Commencement of Business:

This phase of Subsidy planning is very important. Since most of subsidies are connected with the date of commencement of business. So, it become a very crucial part of subsidy planning.

After completion of Building & Other civil work and set up of Plant and Machinery, Unit need to fix up the date of commencement of production of Goods and Services. Such date will be the base of subsidy filling and claiming. At the same times we have to update such date in the MSME Registration Certificate also.

Almost all one times subsidy or incentives shall be applicable only in that case when the unit is in the capacity of starting the production or services as the nature of project.

Actually, this is the phase of filling the subsidy application and implementing the subsidy planning. We can line the subsidy such as:

- Capital Subsidy i.e. Subsidy on Fixed Capital Investment such as PMEGP, CLCSS, Startup, Warehouse etc.

- Stamp Duty Refund

- Refund of EDC Charges

- Electric Duty Exemption etc.

(iii) Subsidy Planning for Continuing of Business:

As we shared that most of businessmen has focused only one time subsidy and incentives. In the lack of proper subsidy planning, they have lapsed the other eligible benefits which are connected with the continuing of business.

So, this phase of subsidy planning will help to manage the cost reduction and improving cash flow in the business. Generally, the subsidy and incentives in this phase are connected with the financial year ending. The major subsidies are as:

- Interest subsidy

- Net SGST Refund

- Employment Generation Subsidy etc.

B. Subsidy Planning for Existing Project:

This phase of subsidy planning is important for any existing business unit. Generally, running units has a mindset that subsidy will be available only for new unit. So, here we would like to share with you that it is not accurate assumption. If you are running any business then also you can take the benefits as per the norms of policy.

We can explore this phase of subsidy planning as “Expansion or diversification of Project”.

If a running unit is going to expand its business or diversify it then it can plan the subsidy benefits. Here important point is the cost of Investment.

For Example:

- PMEGP scheme has a provision of capital subsidy on the extension of the project.

- CLCSS has also the provision of subsidy on Technology upgradation.

- MSME Department has also the provision of subsidy on Lab and Testing Equipment.

- Subsidy provision on Set up Pollution Control Device.

- Provision of Subsidy on set up Solar and other Renewal Energy devices.

- Agriculture infrastructure Fund has also facilitated on Modernization of Units.

- AHIDF (Animal Husbandry and Infrastructure Development Fund) has also the provision of Interest Subsidy for value addition in connected project.

- Ministry of Food Processing has been also providing the grant on Backward and Forward linkage of Project.

Your Subsidy Planning eBook

For, more information on this you are requested to contact our KIP subsidy helpline on Mail – sales@kipfinancial.com and contact Number- +918683898080

KIP Financial Consultancy Pvt. Ltd.

DSB – 38, Red Square Market, Hisar – 125001 (HR)

Leave a Comment