- June 21, 2024

- admin

- 0 Comments

- Animal Husbandry Infrastructure Development Fund

Webinar On Animal Husbandry Infrastructure Development Fund (AHIDF)

Infrastructure plays a critical role in the overall development of a country. In India, where the economy relies heavily on agriculture, the importance of infrastructure development in this sector cannot be overstated. To increase farmer income and enhance projects in animal husbandry and dairying, there is a growing need for infrastructure.

Recognizing this need, the Government of India has announced the Animal Husbandry Infrastructure Development Fund (AHIDF), with a total allocation of Rs. 29,110.25 crores up to the financial year 2025-2026, ending on 31st March 2026.

Project Covered Under AHIDF:

1 Dairy Processing Units :

- Ice Cream unit

- Cheese manufacturing unit

- Ultra High Temperature (UHT) Milk processing unit with tetra packaging Facilities.

- Flavored Milk manufacturing unit

- Milk Powder manufacturing unit

- Whey powder manufacturing unit

- Any other milk products and value addition manufacturing unit.

- Manufacture of any equipment and machinery required for dairy processing.

- Bulk-Vending System, Parlor deep freezer, cold storage.

- Milk transportation system (Refrigerated van/insulated tankers).

- Lab & Equipment, new technology, innovations, product development.

- Renewable energy infrastructure plants, trigeneration systems.

2 Animal Feed Manufacturing Units:

- Mini, Medium & Large Animal Feed Plant

- Mixed Ration Block Making Unit

- By Pass Protein Unit

- Mineral Mixture Plant

- Enrich Silage Making Unit

- Animal Feed Testing Laboratory

- Manufacturing of Feed supplements, Feed Premixes & Mineral mixture plant

3 Meat Processing Units

4. Breed Improvement Technology & Breed Multiplication Farm

5. Sheep/ Goat Farming

6. Pig Farming

7. Layer Farming

8. Hatchery

9. Broiler Breeder Farm

10. Integrated projects for poultry farm and poultry feed

11.Veterinary Vaccine and drugs production facility

12.Animal Waste to Wealth Management

Who can apply:

- Farmer Producer Organization (FPO)

- Private Companies

- Individual Entrepreneurs

- Section 8 Companies

- MSME Unit

- Dairy Cooperatives

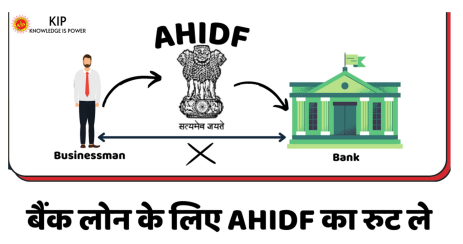

Why opt the AHIDF Route for Bank Loan ?

- Interest Subvention: All loans under this financing facility will have interest subvention of 3% per annum. This subvention will be available for a maximum period of 8 years.

- Interest Subvention on Already Availed Bank Term Loan: Eligible beneficiaries who have already taken a bank loan but have not yet applied for the AHIDF can also benefit from the Interest Subvention under this scheme. However, the interest subvention will be calculated on the interest accrued after the scheme’s notification date, which is 24.06.2020, or the date when the loan was sanctioned, whichever is later.

- Bank Finance up to 90% : The Project under AHIDF shall be eligible for loan up to 90% of Project Cost. The Beneficiaries contribution for Micro and Small Units shall be 10% and in Other Cases it may be 15% to 25%.

- Credit Guarantee: Credit guarantee coverage will be available for eligible borrowers from this financing facility under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme for a loan amount up to Rs. 2 Cr.

- Capital Subsidy: Apart from the benefits of Interest Subvention as provided in AHIDF, Eligible beneficiaries can avail the benefit of any grant or subsidy available under any present or future scheme of Central/State government. For example, if you are planning to Setup Cattle Feed Plant in Haryana then you can avail the benefits of Capital Subsidy @ 15% of Fixed Capital Investment under the Haryana Gramin Vikas Yojna apart from the Interest Subsidy provided under AHIDF.

AHIDF Scheme Applicable On :

- New Units

- Existing Units

For Existing Units :

- Existing Units can also take the benefits of AHIDF For Creating value addition infrastructure.

- If you have availed Bank Term on or after 24.06.2020 then you can also take the benefits of said scheme Interest Subvention.

Basic Eligibility Criteria :

- Local Authority Clearances as per the State Requirements.

- No Objection from the land authority on the lease hold (Min 10 Years ) or ownership of the land .

- Consent to establish (CTE) and Consent to Operate (CTO) from the State Pollution Control Board.

- Trade Licenses.

- Food Safety and Standard Authority Of India

- Water and Air acts

- State Electricity Board

- MSME Registration ( only for MSME companies)

- Registration under companies act (only for companies)

- Registration under Labour Act/EPF Act

- Detailed Project Report

For, more information on this you are requested to contact our KIP subsidy helpline on Mail – sales@kipfinancial.com and contact Number- +918683898080

KIP Financial Consultancy Pvt. Ltd.

DSB – 38, Red Square Market, Hisar – 125001 (HR)

Leave a Comment